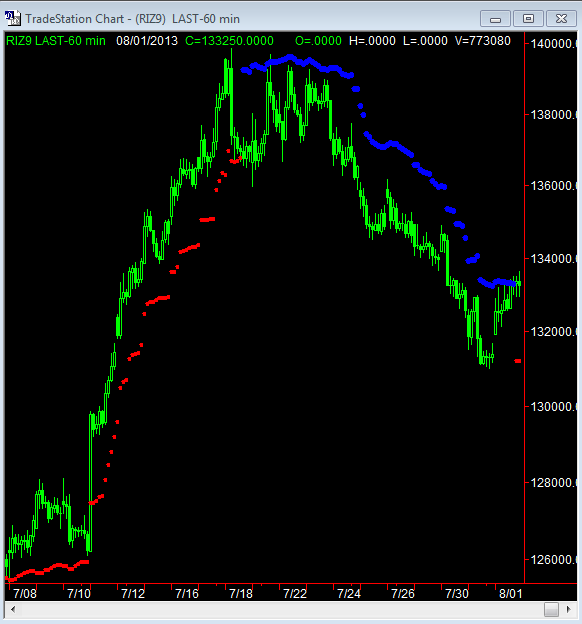

Type : Indicator, Name : Variable Volatility Stops

INPUT: LENGTH (21), CONST(3.05);

vaR: SWITCH(1), TR(0), ARC(0), SAR(0),HISIC(0),LOSIC(0);

TR= VOLATILITY (LENGTH);

ARC= TR* CONST;

IF CURRENTbar = length then begin

hisic=c;

losic=c;

if h>= xaverage (h,length-1) [1] then begin

hisic= highest(c,length);

Sar=hisic-arc;

switch= 1;

end;

if l <= xaverage (l,length-1) [1] then begin

losic= lowest (c,length);

sar = losic +arc;

switch=0;

end;

end;

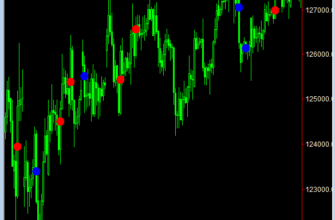

if switch =1 then begin

if c>hisic then hisic=c;

sar=hisic – arc;

if c< sar then begin

switch=0;

losic=c;

sar = losic + arc;

end;

end;

if switch=0 then begin

if c< losic then losic=c;

sar= losic +arc;

if c> sar then begin

switch=1;

hisic=c;

saR=HISIC- ARC;

END;

END;

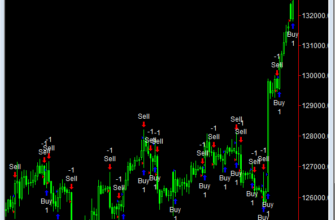

IF C > SAR { AND C[1] < SAR } THEN

Plot1(SAR,”Sell”);

IF C < SAR { AND C[1] > SAR} THEN

Plot2(sar,”Buy”);