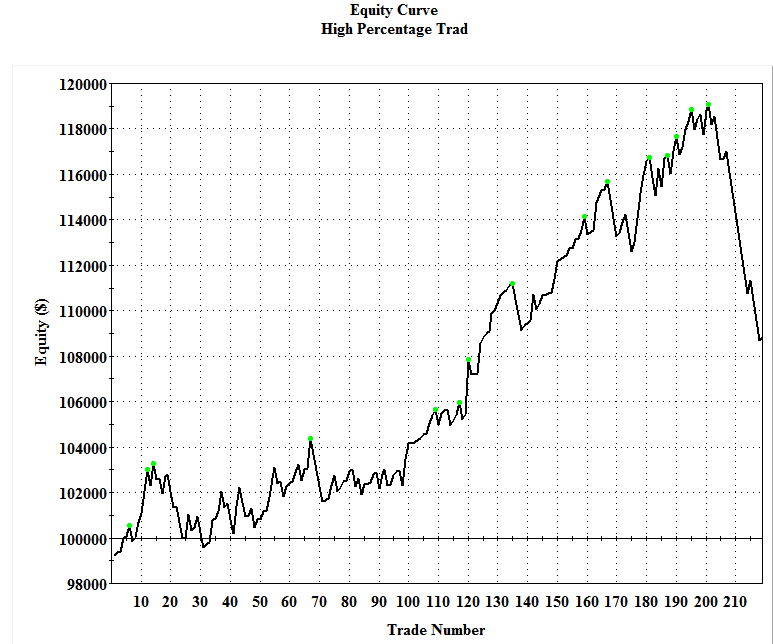

Typ : System, Name : High Percentage Trading System

Input: ASize (30000), { starting account size, $ }

DDGoal (50), { max closed out trade drawdown, % }

RiskPer (10), { percentage risk per trade }

NRand (1000), { number of random sequences }

EntFrac (0.75); { multiple of range for entry }

Var: EntPr (0), { Entry target price }

XitPr (0), { mm stop exit price }

TrRisk (0); { trade risk, $ }

TrRisk = 1000;

EntPr = H + EntFrac * (H – L);

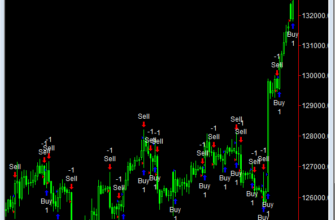

If C > C[1] then

Buy next bar at EntPr Stop;

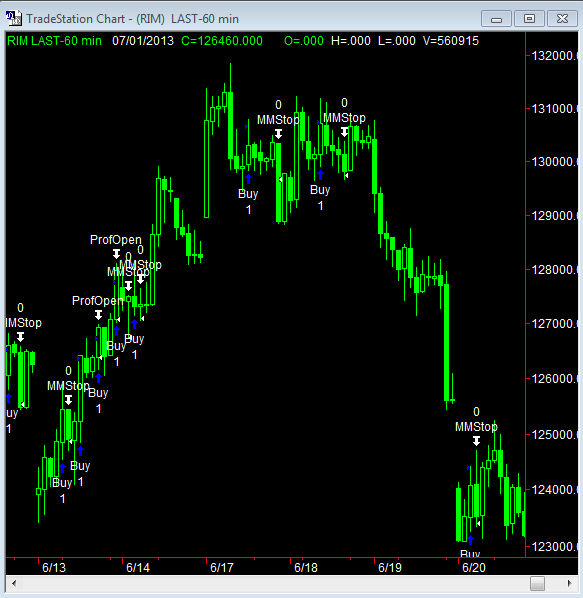

Exitlong(“MMStop”) next bar at EntryPrice – TrRisk/BigPointValue stop;

If BarsSinceEntry >= 1 and open of next bar > EntryPrice then

ExitLong(“ProfOpen”) next bar at market;

{Value1 = MonteCarlo (ASize, DDGoal, RiskPer, TrRisk, NRand);}

{This last line calls the MonteCarlo function, which randomizes the

trades and summarizes the results. Delete it if you don’t want the

MonteCarlo results.}