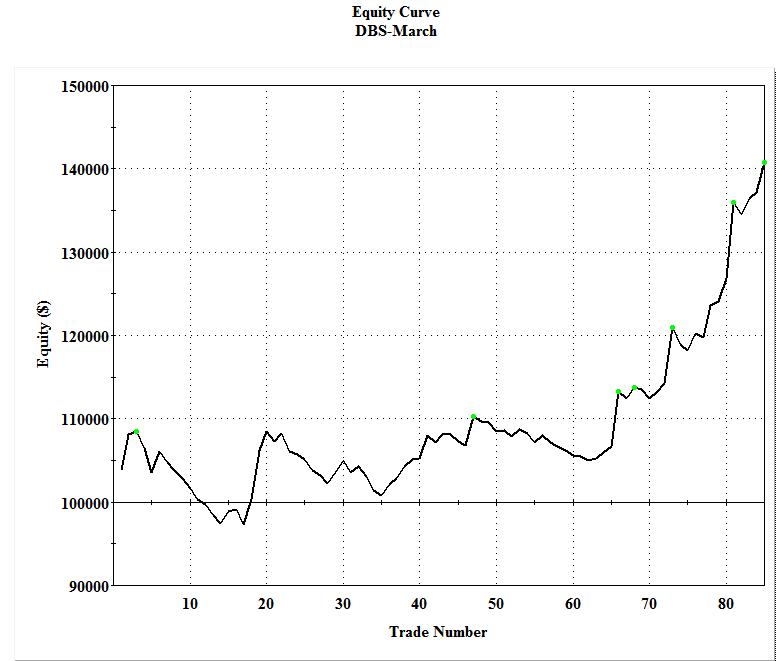

Typ : Signal Name : DBS-March

Inputs: Ceil(60), Flr(20),

{Additional inputs}

TStop1(0), StopB1(999), StopV1(0),

TStop2(0), StopB2(999), StopV2(0),

TAdd3(0), AddB3(999), TStop3(0), StopB3(999), Alpha3(0), Beta3(0),

TAdd4(0), AddV4(0), TStop4(0), StopV4(0), Alpha4(0), Beta4(0);

Var: X(0), Y(0), ZDelta(0), VarA(0), VarB(0), OldVarA(0), Pos(0), OpLoss(0), OpPro(0), BottDay(0), PeakDay(0),

{Additional variables}

Trigger(0), MaxReg(0);

Y = X;

X = Stddev(Close, 30);

ZDelta = (X – Y) / X;

If CurrentBar =1 then

VarA = 20;

OldVarA = VarA;

VarA = OldVarA * (1 + ZDelta);

VarA = MaxList(VarA, Flr);

VarA = MinList(VarA, Ceil);

VarB = VarA * 0.5;

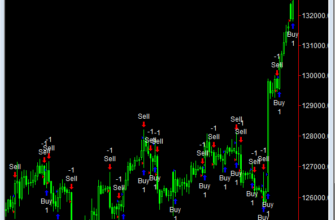

Buy (“Go Long”) tomorrow at Highest(High, VarA) Stop;

Sell (“Go Short”) tomorrow at Lowest(Low, VarA) Stop;

ExitLong (“Exit Long”) tomorrow at Lowest(Low, VarB) Stop;

ExitShort (“Exit Short”) tomorrow at Highest(High, VarB) Stop;

{Additional trading}

If BigPointValue <> 0 and EntryPrice <> 0 Then Begin

Trigger = (PositionProfit/BigPointValue) * 100 / EntryPrice;

MaxReg = (MaxPositionProfit/BigPointValue) * 100 / EntryPrice;

End;

If TStop1 = 1 Then Begin

If BarsSinceEntry >= StopB1 and Trigger < StopV1 Then Begin

If MarketPosition = 1 Then

ExitLong (“Stop Long 1”) tomorrow at Open Stop;

If MarketPosition = -1 Then

ExitShort (“Stop Short 1”) tomorrow at Open Stop;

End;

End;

If TStop2 = 1 Then Begin

If BarsSinceEntry >= StopB2 and Trigger < StopV2 Then Begin

If MarketPosition = 1 Then

ExitLong (“Stop Long 2”) tomorrow at Open Stop;

If MarketPosition = -1 Then

ExitShort (“Stop Short 2”) tomorrow at Open Stop;

End;

End;

If TAdd3 = 1 Then Begin

If BarsSinceEntry >= AddB3 and

Trigger Crosses Over (Alpha3 + Beta3 * BarsSinceEntry) Then Begin

If MarketPosition = 1 Then

Buy (“Add Long 3”) tomorrow at Open Stop;

If MarketPosition = -1 Then

Sell (“Add Short 3”) tomorrow at Open Stop;

End;

End;

If TStop3 = 1 Then Begin

If BarsSinceEntry >= StopB3 and

Trigger Crosses Under (Alpha3 + Beta3 * BarsSinceEntry) Then Begin

If MarketPosition = 1 Then

ExitLong (“Stop Long 3”) tomorrow at Open Stop;

If MarketPosition = -1 Then

ExitShort (“Stop Short 3”) tomorrow at Open Stop;

End;

End;

If TAdd4 = 1 Then Begin

If MaxReg >= AddV4 and

Trigger Crosses Over (Alpha4 + Beta4 * MaxReg) Then Begin

If MarketPosition = 1 Then

Buy (“Add Long 4”) tomorrow at Open Stop;

If MarketPosition = -1 Then

Sell (“Add Short 4”) tomorrow at Open Stop;

End;

End;

If TStop4 = 1 Then Begin

If MaxReg >= StopV4 and

Trigger Crosses Under (Alpha4 + Beta4 * MaxReg) Then Begin

If MarketPosition = 1 Then

ExitLong (“Stop Long 4”) tomorrow at Open Stop;

If MarketPosition = -1 Then

ExitShort (“Stop Short 4”) tomorrow at Open Stop;

End;

End;

{End additional trading}

Pos = MarketPosition;

OpLoss = MaxPositionLoss;

OpPro = MaxPositionProfit;

If OpLoss < OpLoss[1] And Pos <> 0 Then

BottDay = BarsSinceEntry;

If OpPro > OpPro[1] And Pos <> 0 Then

PeakDay = BarsSinceEntry;

{Percentage export}

If CurrentBar = 1 Then

Print(File(“c:\Exam.txt”),”EntryDate”,”,”,”EntryPrice”,”,”,

“MarketPosition”,”,”,”MaxPositionLoss”,”,”,”BottomDay”,”,”,

“MaxPositionProfit”,”,”,”PeakDay”,”,”,”PositionProfit”,”,”,”LengthOfTrade”);

If Pos <> Pos[1] And Pos[1] <> 0 Then

Print(File(“c:\Exam.txt”),EntryDate(1),”,”,EntryPrice(1),”,”,

MarketPosition(1),”,”,(MaxPositionLoss(1)/BigPointValue)*100/EntryPrice(1),

“,”,BottDay,”,”,(MaxPositionProfit(1)/BigPointValue)*100/EntryPrice(1),

“,”,PeakDay,”,”,(PositionProfit(1)/BigPointValue)*100/EntryPrice(1),”,”,

BarsSinceEntry(1));